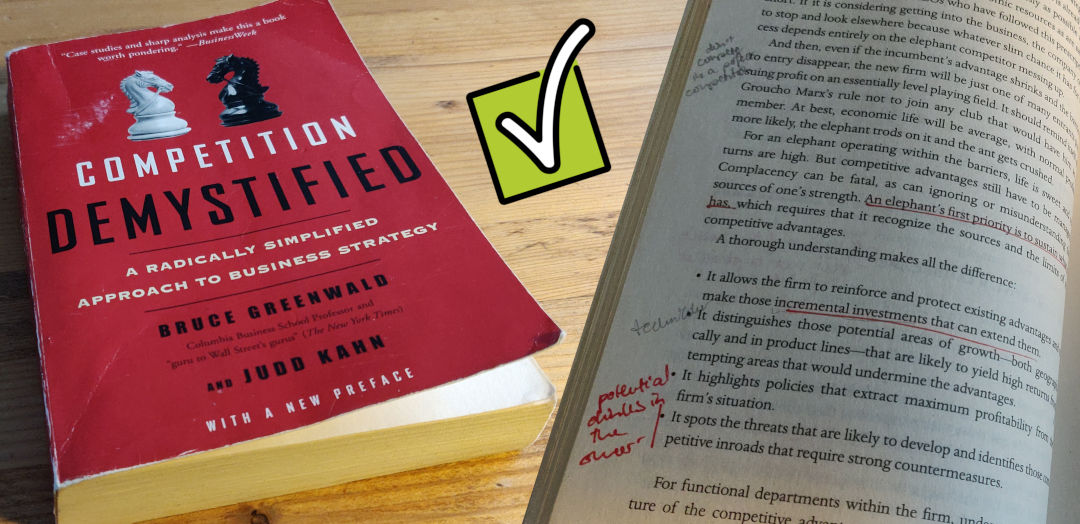

The book this post will be summarizing was found neatly categorized underneath the sign

Of course, you could also just skim this summary. You'll mainly be missing a ton of business stories and analysis, it's up to you if you care for that. For what it's worth, I had fun reading most of the book. There are some chapters where things get a bit slow and repetitive, but they are easily skipped. You won't miss much when doing that.

Above is a diagram, which is at the core of the entire book. You follow it by answering question about the market you are in (or plan on entering), and you end up at the most optimal strategy to follow. I annotated it a bit, just like the previous owner of my copy did for me. The green circled areas are where the book really wants you to end up, especially at the top, as a single dominant firm. The authors really think you are screwed when your only strategy is efficiency. This comes down to margins. A single dominant firm can have huge margins, whereas a generic firm in a highly competitive field will need to optimize to nearly no margins at all.

What makes your company unique? What is the reason for your company being the Single Dominant Firm? Answer those questions, and find a way to protect and leverage them to your benefit. If you keep doing this, your margins will stay high and your future will be bright.

There are a couple of common advantages that the authors describe, which you should look for:

-

Customer Loyalty

How likely are your customers to move to a competitor? Do they identify themselves using your brand, e.g. Apple? Then you are less likely to lose customers due to newly entering competitors, they have to compete with emotions and social ties.

-

Cost of moving

We are not talking about the sunken-cost fallacy, although that might help. It can be prohibitively expensive to move to a new service provider. For instance, moving to a different B2B service provider might temporarily restrict access to that service, lost time, productivity, and thus money. The new service might be cheaper, but it has to significantly outweigh the cost of moving.

-

Proprietary technology

You might know the type of company: the kind that invented some weird valve or switch, and they own all the rights to production. Interestingly enough, in my experience, these are often family businesses. They milk these rights for a generation or two, whereafter they usually get absorbed by a bigger fish. Enough time to build some generational wealth, but also according the authors, an advantage with a deadline.

-

Economy of scale

The authors love this one, even though they also show how this is more rare than you'd think. There rarely is such a thing as "synergy", and scale does not automatically mean you have an impenetrable barrier against competitors. The scale must reduce costs significantly, and should be very hard to replicate without significant investment from the company.

So you still have things that make your company unique, but there are multiple companies in the market fighting for your piece of the cake? There is still hope! In fact, this is where the book spends most of its time, it is very interesting!

The authors define three different approaches to defending your margins in a crowded market. Which one you use, depends on the specific market conditions. In fact, you might use a bit of all them.

-

Game Structure / Simulation

This, in my opinion, is the most complex situation to be in. It comes down to analyzing all the actions your competitors can make and simulating what would happen if you make certain countermoves. You also take into account the results of these actions, and to motives behind them.

In a different context, we call these "war games". You don't need a computer to do this either, a couple of strategists can come together and "play" different competitors in a simulated market. The most insight is gained if multiple rounds are played, with varying choices. Of course, we could simulate this with computers as well. I believe we call this multi-agent simulations in Computing Science.

-

Prisoner's Dilemma / Entry Preemption

The graph below is taken directly from the book. It lays out the different choices two competing supermarket chains can make, when one of them (Home Depot) is just entering the same market as the other (Lowe's).

We call this an entry / preemption game. It tells you what to do when entering a new market, and when somebody else is entering yours. There are four outcomes:

- A : Lowe's does not fight back and loses 2M, Home Depot gains 1M by entering the market.

- B : Lowe's fights back, requiring Home Depot to Resist as well. After this Lowe's draws back. Lowe's loses less of the market (1M lost), and Home Depot gains less of it too (0.2M gained).

- C : Lowe's keeps fighting back, just like Home Depot. Both lose money undercutting each other. Lowe's is the bigger giant, and loses 3M as to Home Depot's 2M.

- D : Home Depot never enters the same market, so nothing changes.

Now, you must wonder where these estimation come from. Although the authors are a bit less hand-wavy about them than I am in this summary, they don't provide a strong backbone for them either. We have to trust on their expert insight and experience. Thus, when applying this to your own strategic analysis, you will need to find your own basis of estimating the cost of these choices.

That said, in this instance you would go for option B: you push back initially and hope that they'll back off. If they keep going, you let them into your market and you lick your wounds.

Often there are many more choices available, and you could also keep extending the above graph, making it deeper and giving you an endless list of options to choose from. This is where we end up in the aforementioned field of simulation. It is up to the strategist to choose what model is accurate enough in order to make a timely choice and not be weighed down by irrelevant alternatives.

Another variant of this model is what is known as the Prisoner's Dilemma, which narrows down the options to a binary: collaborate, or don't. The authors demonstrate that with a matrix, with both the rows and columns showing the two different prices the aforementioned supermarkets could have charged.

Here you can see that the best overall option is to collaborate (A), as both get to charge the most amount of money. Which leads us to Cooperation / Bargaining. Of course you could defect while the competitor cooperates and get an even bigger share of the pie (B or C), but you are far more likely to end up in a situation where everyone loses (D). It is important to remember that you only know your opponent's move after you have made yours.

-

Cooperation / Bargaining

This builds on the main concept behind the prisoner's dilemma: you really don't want to fight when there is a chance for everybody to win and earn lots of money. You might see this as a nice opportunity to commit some totally radical white collar crime, and collude to your heart's content. The author's are aware of this, and do warn the reader to stay within the legal boundaries, although not without sounding a bit disgruntled at the need to do so.

We want to "Maximize the attainable joint rewards" and "Divide the gains in rewards according to the principles of fairness". At least, that is how the authors put it. It comes down to signalling to every competitor that it's in everybody's best interest to keep prices going up instead of down, and secondly to try and optimize the entire market as if it is one big monopoly. For example, the latter might mean that you sell your base resources to a competing company if you have an excess of it, benefiting both you and your competitors and keeping efficiency high.

So, what are the principles of fairness? Well, it's something invented by mathematician John Nash, who won the Nobel Prize for it (and other things). For us the most important thing to understand is that for stable cooperation to exist, all involved must be satisfied with the benefits gained from working together. If a single player drops out, the whole system can fail. For instance, if once company starts cutting prices, suddenly everyone else has to follow in order stay competitive. The authors call for the need of "perceived fairness", and describe three of John Nash's criteria as the most important factors in sustaining it.

- Individual Rationality : collaborating with others should not negatively affect the cooperation. It is also known as BATNA : Best Alternative To a Negotiated Agreement. If there is a better alternative than working together, there cannot be fairness.

- Symmetry : all benefits from cooperation between essentially identical companies should be shared equally. If one company gains a disproportionate amount of profit from cooperating with other companies, then there cannot be fairness.

- Linear Invariance : this expands on the symmetry requirement by basically mentioning that if a company in a cooperative market has twice the size or strength as the other companies, then it is only fair it benefits twice as much from the cooperation. If a company is doing almost all the work, while others are barely contributing while still benefiting an equal amount, then there cannot be fairness.

Those were, in my experience, the most important parts of this book. Again, I really recommend giving it a read. The stories in this book are about real companies, and their analysis of them really helps with making the notes I made above make sense. Hopefully this page can serve as some sort of cheat-sheet, or in kinder words, reminder for the book.